Walmart sales tax calculator

2253 As of Jul. Up to 4 cash back Shop for Calculators in Office Supplies.

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

More about shipping sales tax codes.

. California State Sales Tax. Log in to the Walmart Seller Center. You can calculate the sales and use tax rate in your area by entering an address into our Sales Tax Calculator.

How much is sales tax in Santa Monica in California. The effective tax rate represents the percentage of Earnings Before Tax paid out in taxes. Youll use this list to complete Item Setup BUT do not need it to.

255 divided by 106 6 sales tax 24057 rounded up 1443 tax. Effective Tax Rate for Walmart is calculated as follows. 10500 In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return.

Walmart Tax Rate. This will provide a combined sales tax rate for a location. 10000 Total CostPrice including ST.

For a look at sales. Locate the Tax Setup page. The sales tax rate for Santa Monica was updated for the 2020 tax year this is.

For questions about filing extensions tax relief and more call. Select all the states in which you have nexus. Sales tax in Santa Monica California is currently 10.

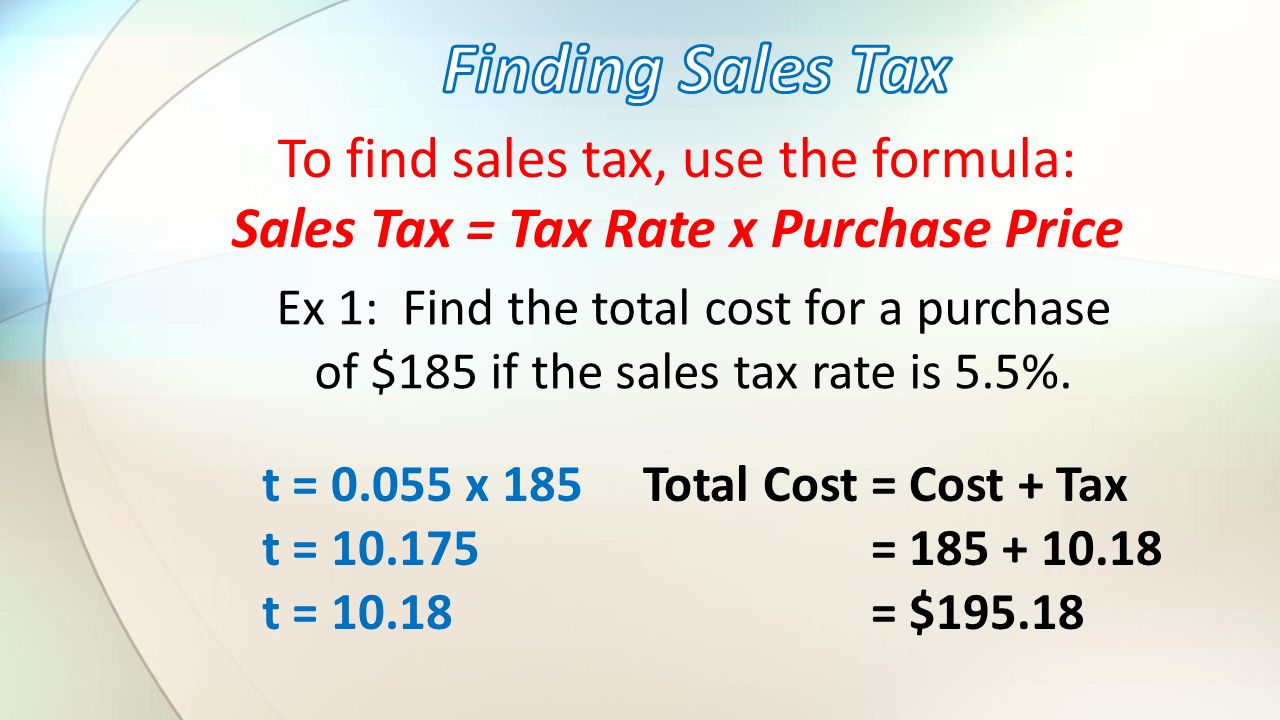

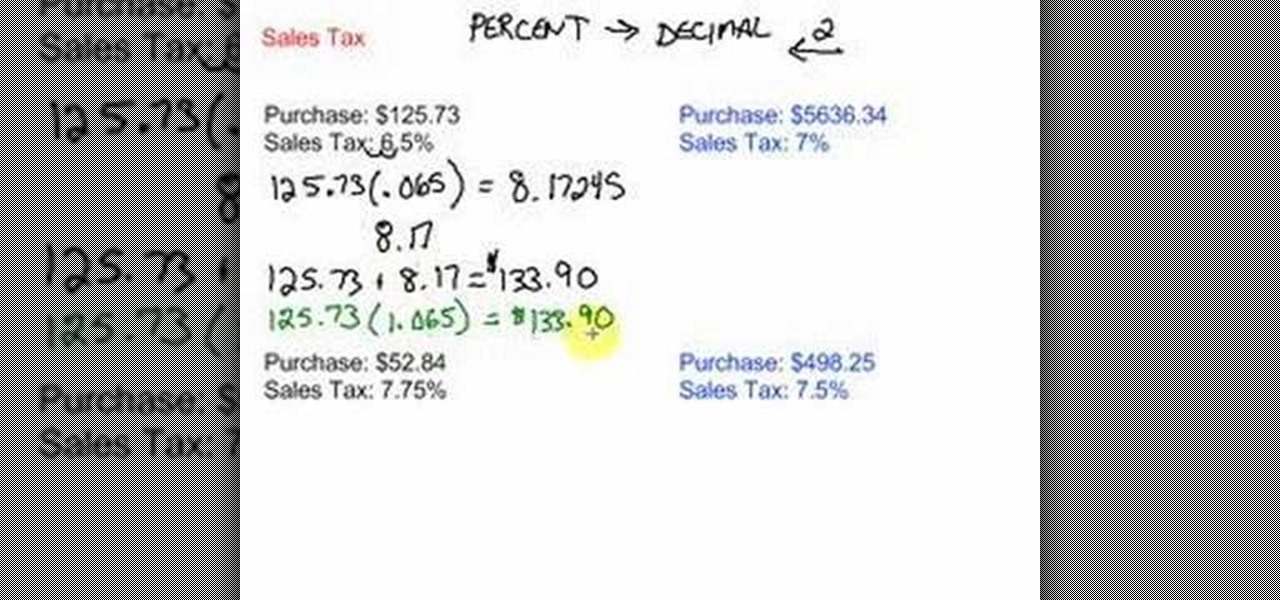

500 CostPrice before ST. How to Calculate Sales Tax Multiply the price of your item or service by the tax rate. Tax Rate is calculated as Tax Expense divided by its Pre-Tax Income.

To calculate the amount of sales tax to charge in Los Angeles use this simple formula. It is very important to follow Configuring Your Taxes in the. Online videos and Live Webinars are available in lieu of in-person classes.

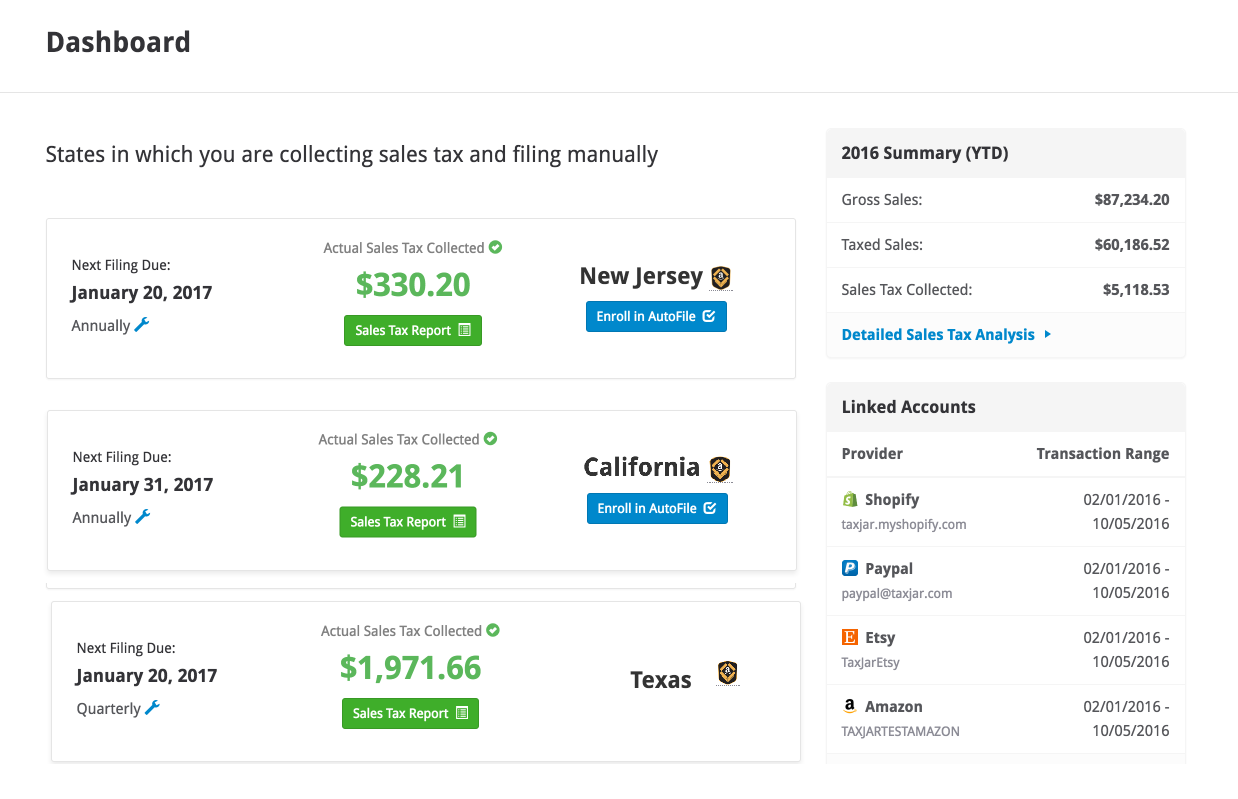

Accuracy guaranteed With economic nexus determination and guaranteed accurate calculations TaxJar ensures you. Filing and remitting sales tax for your Walmart store has never been easier. How do you figure out what the sales tax rate is.

Skip to Main Content. Maximum Possible Sales Tax. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax.

2022 View and export this data going back to 1970. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. Sales tax total amount of sale x sales tax rate in this case 95.

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Average Local State Sales Tax. Provision For Taxes 4459 B.

Buy products such as Texas Instruments TI-30X IIS Scientific Calculator 10-Digit LCD at Walmart and save. Download the current Sales Tax Codes for Walmart Marketplace by clicking below. Start your Free Trial.

Maximum Local Sales Tax. Or to make things even easier input. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Sales tax is calculated by multiplying the purchase price by the sales.

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

How To Calculate California Sales Tax 11 Steps With Pictures

Sales Tax Calculator Taxjar

Sales Taxes In The United States Wikiwand

Sales Tax On Grocery Items Taxjar

How To Calculate California Sales Tax 11 Steps With Pictures

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

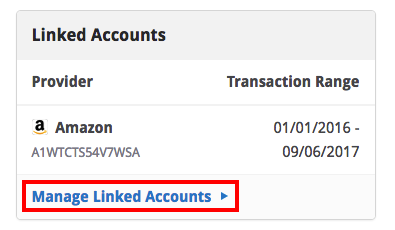

Walmart Integration Taxjar

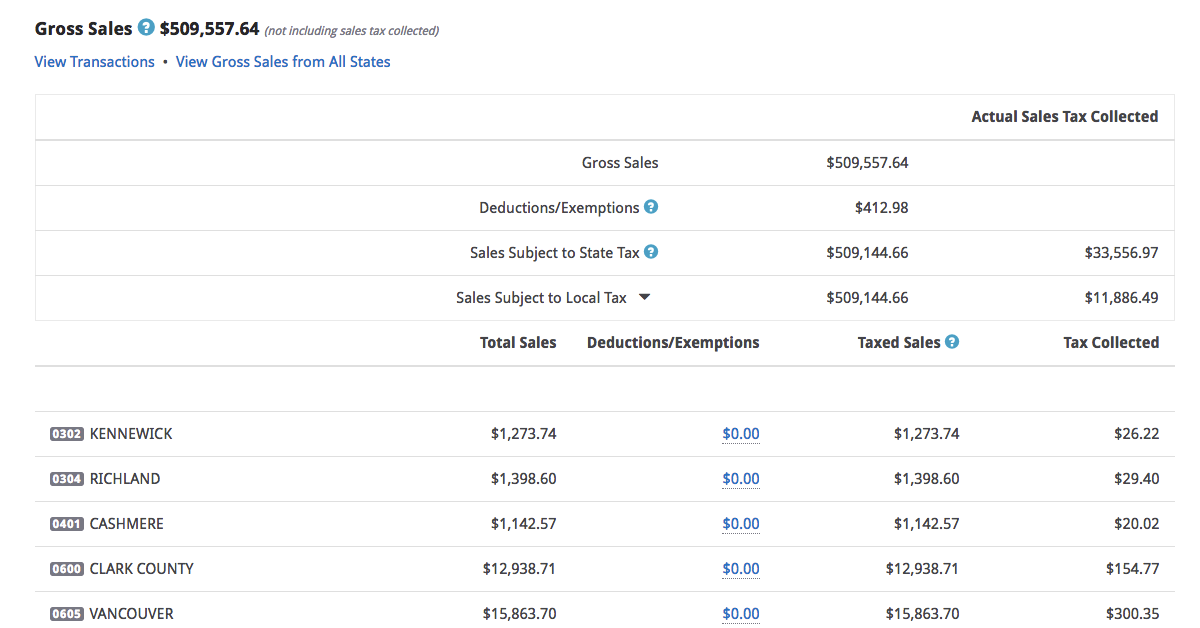

How To Charge Your Customers The Correct Sales Tax Rates

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

Updated Discount Sales Tax Calculator App For Pc Mac Windows 11 10 8 7 Android Mod Download 2022

Configuring Sales Tax At Walmart Com Without Breaking A Sweat

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com